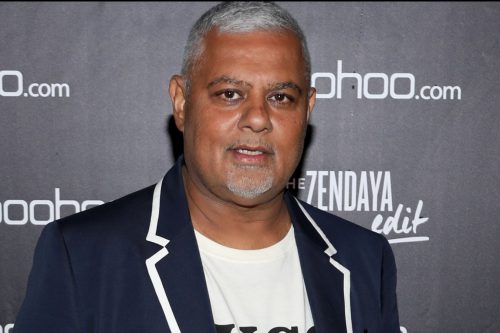

Another rough week for Mahmud Kamani

It’s been a grim week for Boohoo founder Mahmud Kamani.

Chinese fast fashion business Shein has overtaken Boohoo in sales of its cheap clothes reporting revenue of £1.55 billion over the past year.

What must also stick in his throat is that Shein has the same image problems as Boohoo, with concerns about working conditions and the impact of fast fashion on the environment.

Boohoo’s share price has continued to languish uncomfortably close to a historic low of 30p.

Added to this are problems at Revolution Beauty, the troubled online cosmetics business that Kamani fought hard to take control of in a bloody boardroom coup over the last year.

It reported worse than expected revenues of £72million this Wednesday, causing shares to fall sharply as this represented a £11.3m hit to earnings related to the clearance of discontinued stock.

The group is in the process of a turnaround after a 2022 probe found serious accounting irregularities, sparking costly legal battles, a boardroom coup and a near-collapse in its valuation.

Russ Mould, investment director at AJ Bell summed up Boohoo’s woes in a blistering commentary this week: “Boohoo’s bosses are probably looking for a handkerchief. Sales have tanked, the share price is in the doldrums and rumours are swirling that the company is on the cusp of a massive break-up. It’s carrying too much debt; it’s faced question about the treatment of suppliers; its shopper has been put off by return charges and its offering has somehow fallen out of fashion.

“Think of brands like Topshop, Karen Millen and Debenhams in their heyday. Stores that were beloved by their customers but easily forgotten now they’re not front and centre on our high streets.

“Sometimes big is beautiful and sometimes it’s too unwieldy. In Boohoo’s case it seems like a business that grew too quickly and couldn’t quite figure out how to manoeuvre.

Mould also described the Revolution Beauty results as “a very ugly set of results” drawing the inference that is adding to Kamani’s headaches.

“However, it has very little credit in the bank with investors and it will be interesting to see what major shareholder Boohoo does with its stake as it reportedly considers selling off assets in the wake of its own indifferent performance.”

However, he did see a glimmer of light for Revolution Beauty as the new leadership shifts away from non-core products to its core brands which may lead to improved profitability in the underlying business with new product launches and developing relationships with major retailers in Germany, the UK and the US, including Boots and Walmart.

That might make it easier to sell however, and give Kamani one less thing to worry about.