City round-up: Volex; Marshalls; THG

Warrington-based cables group, Volex, reported strong momentum during the 26 week period to September 29, and said its full year expectations remain unchanged.

In an interim update today, it said the group’s financial performance was in line with expectations, with revenues in excess of $510m. It added that this performance demonstrates the continued resilience of the company based on strong relationships with blue-chip customers across its five end market sectors.

Constant currency organic revenue growth for the first half of the year was 9.7%, including a substantial increase in Electric Vehicle revenues and a return to revenue growth in Consumer Electricals.

As guided at the full year results, Medical revenues were slightly lower against a strong prior year comparative which beneftted from a catch up in the post-Covid supply chain.

Complex Industrial Technology delivered good growth with a strong increase in high speed data centre products offsetting softer demand from industrial customers. Off-Highway also experienced good growth across a broad customer base.

Margin resilience supports continued investment in growth

The group said it expects to deliver operating profit margins for the first half consistent with the board’s through-cycle target of 9-10%, despite the recent inflationary cost pressures in Turkey.

This strong performance provides the group with confidence to continue investing in capacity and capability growth as outlined at the full year results. In addition, productivity improvement activities are being accelerated as part of the Murat Ticaret integration programme, resulting in an offset of localised labour cost pressures.

Looking ahead, Volex said the group is benefiting from a diversification strategy targeting structural growth markets and leveraging strong customer relationships, and is well positioned to continue the current momentum through the second half of the year, with full year expectations unchanged.

Half year results are scheduled for publication on November 15.

::

In a trading update for the nine months to September 30, it revealed a resilient performance in continued weak end markets with YTD group revenue of £476m, compared with £528m in 2023.

Group revenue during Q3 was three per cent lower than the prior year, it said, a material improvement over the 12% like-for-like reduction in H1.

It reported double-digit growth in Roofing Products in Q3, driven by a very strong Viridian Solar performance, although there were flat revenues in Building Products in Q3 together with a lower rate of contraction in Landscape Products during Q3 compared with H1.

Pre-IFRS16 net debt reduced in Q3 to £149m, driven by a continued focus on cash management.

Landscape Products’ revenue in the period was £209m (2023: £257m), which represents a like-for-like reduction of 17%, compared with 2023. The like-for-like rate of contraction slowed in the third quarter to 13% from the 19% reported at the half year, principally driven by a moderation in the decline in new house building and private housing RMI end markets.

The board said it continues to focus on its transformation programme to strengthen the leadership team and customer relationships and improve the performance of the segment.

Building Products’ revenue was £128m (2023: £133m), which represents a reduction of four per cent over the prior year with Q3 being in line with 2023. The Q3 performance comprises growth in the drainage and bricks businesses, which was offset by a contraction in revenues in the mortars and aggregates businesses.

Roofing Products’ revenue was £139m (2023: £138m), marginally ahead of the prior year. In the third quarter, the segment delivered growth of 12% which comprised a modest increase in Marley, together with growth of around 70% in Viridian Solar.

The increase in Viridian Solar was driven by a combination of the continued ramp-up in activity arising from Part L building regulations that are focused on increasing energy efficiency, and weaker prior year comparatives as new build housing volumes slowed in the second half of 2023.

The group’s balance sheet continues to be robust, with pre-IFRS16 net debt of £149m at the end of September 2024 (September 2023: £190m, June 2024: £156m).

Net debt is, therefore £41m lower than the prior year, reflecting strong organic cash generation and a continued focus on cash management.

The group repaid a further £25m of its term loan in early October 2024 to optimise its financing costs and, following this payment the outstanding balance is £155m. The group’s £160m revolving credit facility was undrawn at the end of the period.

Marshalls said, in anticipation of a continued improving demand environment for its products, the board expects that profit for the full year will be in line with its previous expectations and that pre-IFRS16 net debt will be modestly better than its previous expectations.

::

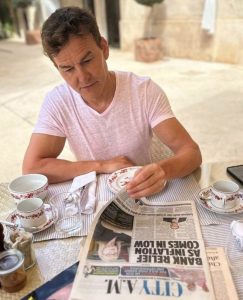

Matt Moulding reads City AM, which he now owns

THG founder Matthew Moulding has purchased 20,408,163 ordinary shares of £0.005 each at a price of 49 pence per share.

The purchase was done through FIC Shareco Limited, an entity closely associated with Matthew Moulding.

This purchase takes Matthew Moulding’s direct and indirect holding to a total of 341,342,346 shares in the Company, comprised of 219,152,258 ordinary voting shares and 122,190,088 unlisted ordinary shares, in each case of £0.005 in the capital of the Company.