Budget 2021: ‘You cannot hold back the tide of online retail with a tax’

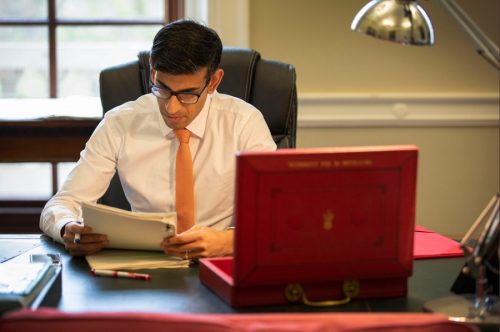

Ahead of Wednesday’s Budget, specialists from accountancy and advisory firm, MHA MacIntyre Hudson, share what they expect Chancellor Rishi Sunak to reveal.

Nigel Morris, employment tax director at MHA MacIntyre Hudson, says extending the furlough scheme is the right call but with no sector distinctions and ought to go hand in hand with a return of the Job Retention Bonus scheme.

Nigel Morris, employment tax director at MHA MacIntyre Hudson, says extending the furlough scheme is the right call but with no sector distinctions and ought to go hand in hand with a return of the Job Retention Bonus scheme.Morris said: “Extending the furlough scheme until the summer, as the Chancellor looks likely to do, is certainly the right call. We will all be paying for the cost of the Covid-19 support measures for a long time, and extending this scheme a little longer won’t massively increase this bill.

“In addition to an extension though, employers need further incentives to get furloughed employees back to work. The Chancellor also needs to think about job support over the long-term and not just for now.

“The best way to complement a CJRS (aka furlough) extension is to bring back a version of the Job Retention Bonus scheme. This would be especially helpful to those employers who need to phase the return of their employees back to work. The prospect of a one-off payment when furloughed employees return to work would give them an extra ‘crutch’ if they need to fund furlough and employer’s NIC after April 2021 until their businesses are able to fully open again.

“Looking ahead, it is surely worth the Chancellor’s time to consider whether some kind of furlough scheme should become permanent, perhaps along the lines of arrangements available in France, Germany or the USA. With the rise of new Covid-19 variants other, hopefully less restrictive, lockdowns in the autumn or winter can’t be ruled out. The UK should think about drawing up plans for a more long-term but less generous retention scheme until we are totally clear from the pandemic.

“Some others ideas that the Chancellor might try but are less advisable include making furlough sector specific, to account for the especially severe impact of the lockdown in areas such as travel and hospitality. This has always been a popular solution but is actually fraught with complexity and is unlikely to happen. The furlough scheme was introduced at very short notice and required the building of new IT systems to help counter erroneous or fraudulent claims. It is hard to see how the system could be quickly reconfigured to check that only employers from the right sector are allowed to claim. Especially as we want to avoid any abuse of the system.”

Chris Denning

Meanwhile, Chris Denning, corporate and international tax partner at MHA MacIntyre Hudson, says you cannot hold back the tide of online retail with a tax.

He added: “There have been recent reports that the Chancellor is considering imposing an online sales tax to shift the balance back in favour of the high street. However, the Chancellor risks jumping the gun and a thorough analysis of the societal shift against ‘bricks and mortar’ retail is needed.

“The key question about an online sales tax is whether we are witnessing a permanent shift away from the high street model. If we are, simply introducing a single tax measure is not going make a fundamental difference to the high street’s difficulties.

“The best way to help ‘bricks and mortar’ retailers is to conduct a full and informed analysis of the societal factors which are driving both business and consumer behaviour and the likely future direction of travel. This should help the high street adapt. Ultimately changing to suit consumer needs is a more viable strategy than trying to hold back the online tide with a tax.

“It is unlikely to be all bad for traditional retail. The current pandemic has clearly highlighted people do not want to spend their lives cooped up in their homes, so there is no doubt a place for the high street where people can meet, socialise and spend their disposable income – the question is what form the high street should take to respond to societal needs. A new tax will not absolve us of the need to find an answer to that question.

On business rates, Joe Sullivan, partner, and Alison Conley, corporate and international tax partner, add: “The business rates holiday in England is currently due to end on March 31. An overhaul of the current regime, something already needed in a pre Covid-19 existence, would be of great benefit – indeed, after observing a clear divergence in the financial fortunes of ‘non-essential’ retail businesses, the pandemic effectively mandated it as essential.

“The government has urged councils not to issue business rates bills ahead of the new 2021/22 financial year, signaling that further support for occupiers of commercial property, like shops, pubs and restaurants is coming.

“This can only be welcomed as a boost to the struggling high street although a more fundamental reform of business rates is needed for the future.

The leisure and hospitality sector needs bold and sweeping measures to save UK hospitality, extending 5% VAT rate alone is not enough, says Sue Rathmell, VATpartner: The Chancellor is under pressure from the UK hospitality sector to extend the 5% VAT rate, which is due to revert to 20% with effect from 1 April 2021, for at least another 12 months.

“However, this move won’t be enough on its own as most hospitality businesses have not seen a huge benefit from the VAT reduction since it was introduced last year. This is because the UK has been in lockdown for long periods and many people have not been able or wanted to travel away from home and spend money in the hospitality sector.

“Failing to extend the lower VAT rate will force more restaurants and pubs to close their doors as they await the anticipated easing of the lockdown. They desperately need a good summer 2021 season to help save jobs and shore up their finances to be able to survive the current crisis.

“In order to bounce back, the hospitality sector needs the government to step up and increase support. An extension of the furlough scheme is essential, together with more government help for the sector similar to the innovative £100m fund set up by the Scottish government to provide grants directly to tour operators, visitor attractions, hostels and other hospitality businesses in Scotland. The travel industry in other parts of the UK need grants like these.

“The Government could also extend the 5% VAT rate to alcohol in pubs and restaurants or reduce duties on alcohol. Businesses that cannot offer takeaway or do not have gardens or outside space should also be given additional grants. Another ‘Eat out to help out’ scheme should be on the cards when it is safe to do it. In addition, government backed campaigns to encourage people to holiday in the UK should be considered by Rishi Sunak.

“The regrowth of the hospitality sector is also closely dependent on the successful reinvigoration of the UK’s high streets and city centres – encouraging people back into towns and cities will support pubs, restaurants, hotels, cinemas and theatres. The Chancellor and the government need to be fearless and creative with how they get the UK back up and running again as Covid-19 restrictions are lifted. Our hospitality and tourism sectors depend on it.”

Jay Bhatti, R&D tax reliefs specialist says there are a number of ways that R&D schemes and incentives could be improved to benefit the economy, including a cash credit cap for loss-making companies claiming under SME R&D Tax Relief.

He said: The upcoming cap on cash credits paid out to companies is to be set at three times the PAYE + NIC contributions the company or group made in the period. This cap can only be unlocked where IP can be demonstrated. Therefore, it would help immensely to clarify how the IP position of a company will be verified. Where there is no direct reference to IP – companies should be allowed to demonstrate genuine technological problem-solving activities. The cap would discriminate against these smaller companies. The cap should be expanded to enable claimant companies to include UK subcontractors (proposed legislation only allows for PAYE + NIC of related parties to be included).”

Chris Barlow, MHA MacIntyre Hudson

On the manufacturing sector, Chris Barlow, partner and Alastair Wilson, partner, said: “Going on the assumption that lockdown measures will reduce as vaccination progresses, the focus should be on recovery and sustainable measures – not just short-term emergency measures.”

The pair say there are several measures that the Chancellor could announce in the Spring Budget which would benefit the Manufacturing sector, these include:

– A focus on job creation, particularly for younger members of society – any policies must enable SMEs to participate easily (the Kickstarter program for examples is very unwieldy)

– Address the issues caused by the Trade & Co-Operation Agreement (aka Brexit). Lots of businesses are just giving up on exporting because of all the red tape involved now – which will impact on growth

They added: “There is a suggestion that corporation tax may go up – most manufacturers pay less than the mainstream rate of corporate tax, for example due to capital allowances and R&D claims, but anything which discourages investment should be avoided.

“We’ve seen a trend over recent years of manufacturers shortening their supply chain through onshoring or reshoring, etc, and with the current situation this has gathered pace. Several manufacturers are looking at what isn’t available in this country and investing money to see if they can develop it themselves. They can gain R&D tax relief to do this, but it needs to be safeguarded for the process to be able to continue and all it means for inward investment in the UK.

“The move toward further automation within the manufacturing process should be encouraged by way of reliefs perhaps linked to the whole skills debate.”

TheBusinessDesk.com, in conjunction with MHA MacIntyre Hudson, will bring you all the latest breaking Budget news as it happens on Wednesday.