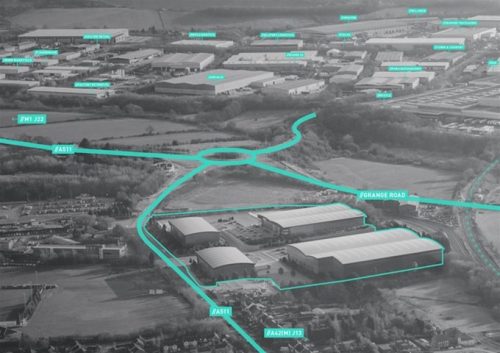

200,000 sq ft speculative industrial scheme secures funding

A 200,000 sq ft speculative development of industrial units is set to be built in Leicestershire after a £17.6m funding deal was agreed.

Barwood Capital, the Northampton-based UK regional real estate investment and development specialist, in a 50:50 joint venture with Merseyside Pension Fund, has agreed funding package for the Tungsten Park project in Bardon, an 11.25 acre site in Leicestershire.

Tungsten Properties will speculatively develop a four-unit industrial scheme totalling 200,550 sq ft.

This is the first time that Merseyside Pension Fund has entered a joint venture with Barwood Capital, having previously also directly invested in Barwood Capital’s third growth fund, the 2017 Property Fund.

Ed Henson, director, Barwood Capital said: “Our investment in Tungsten Park Bardon has meant that we have secured a fundamentally core industrial warehouse site at a good value where there is limited supply and strong, long-term demand. Alongside Merseyside Pension Fund, we hope to play an important part in providing regional jobs and investment despite the challenges that Covid-19 has brought during such a difficult time for the economy and all households across the UK.”

Jeff Penman, managing director, Tungsten Properties said: “Being very mindful of current market uncertainties, our first partnership with Barwood Capital’s Growth Fund IV has come at a time when demand in the industrial market is strong over the medium term, especially in such proven regional locations such as Bardon. We are very optimistic about the resilience and growth potential of this key UK sector which has been highlighted during the current crisis.”