Private sector business activity declines, while prices rise

Business activity continued to fall across the North West’s private sector economy during November, in line with signs of further weakness in demand for goods and services, the latest Regional PMI data from NatWest showed.

Elsewhere, the survey signalled that firms’ input costs and output prices continued to rise sharply, albeit at slower rates than in recent months.

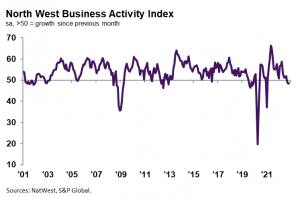

The headline North West PMI Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 48.5 in November, little-changed from October’s 48.4.

A reading below 50, which signals falling business activity, has now been recorded in each of the past three months. The modest decline in output was led by weakness in the manufacturing sector.

November saw a fifth straight monthly decline in inflows of new work across the North West private sector, highlighting a sustained weakening in underlying demand for the region’s goods and services. Uncertainty among customers and high inflation were the main two factors weighing on sales activity, anecdotal evidence showed.

Furthermore, the rate of decline in new orders continued to gather pace, reaching the quickest since January 2021 and outstripping the UK average.

They were still the second lowest since the initial COVID-19 wave, however, reflecting ongoing concerns towards high inflation, rising interest rates, and the prospect of a recession.

Higher energy costs, a weak pound and rising salaries each contributed to an ongoing sharp increase in businesses’ operating expenses during November.

The rate of input price inflation ticked down for the sixth month in a row and was the lowest since May 2021. But despite this, it was still well above its historical series average. In contrast to the trend seen throughout most of the past two-and-a-half years, it was services firms, rather than manufacturers, that saw the strongest cost inflation.

Rising costs spurred many firms across the North West to increase their output prices during November.

However, although still historically elevated, the rate of inflation in average charges for goods and services slipped to its lowest since April 2021, and was the second weakest among the 12 monitored regions.

Latest data showed a further increase in employment across the North West private sector, extending a sequence of uninterrupted job creation stretching back to March 2021.

The pace of hiring picked up only slightly from October and was the second weakest in the aforementioned sequence, however.

Recruitment activity was mainly centred on the service sector, where there were reports of sales staff being added and firms planning ahead for future growth.

A lack of incoming new work during November meant that firms across the North West were able to reduce outstanding business – ie orders received but not yet completed. It marked the sixth month in a row in which a decrease in work-in-hand has been recorded, pointing to easing business capacity pressures. The rate of decline was slightly faster than in October, though still only modest overall.

Malcolm Buchanan, chair of North Regional Board, said: “The North West business activity index remained in sub-50 contraction territory for a third successive month in November, signalling a sustained slowdown in the region’s private sector economy.

“The survey pointed to strong downward pressure on demand, as the decline in new orders deepened under the weight of high inflation and uncertainty.

“A more settled political backdrop helped ease businesses’ nerves about the economic outlook somewhat, with expectations picking up from October’s recent low, but confidence nevertheless remained relatively subdued owing to continued concerns towards rising interest rates and the prospect of a recession in the UK.”

He added: “Firms’ input costs and output charges continued to rise sharply, but the fact that the rates of increase have slowed offers a glimmer of hope that underling price pressures are easing.”