Latest revenue index says SMEs should prepare for volatile trading conditions

Overall turnover in SMEs saw a slight uplift in the second quarter of 2022, following a dip in the first quarter, but the latest SME Revenue Index from Liverpool-based Bibby Financial Services (BFS) warns this could be the calm before the storm.

It says with rate of growth in transport and wholesale SME turnover already easing off, this could be the last positive uptick for the year, as rising costs and decreasing demand take a toll on profit margins across industries.

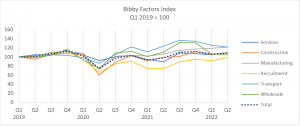

The BFS index tracks quarterly turnover of more than 2,000 small to medium sized enterprises across six key sectors. The data, which uses turnover in Q1 2019 as the base comparison point, highlights subdued growth across the months of April, May and June 2022, with SME turnover rising by just three points to 109 in Q2, up from 106 in Q1 this year

The index, which looks at three years of turnover data, demonstrates that many SMEs recovered well from the pandemic, with overall business turnover having improved by 10 points over the past year, up from 98 in Q2 2021 when pandemic restrictions were still in place.

However, these figures mask a hugely volatile landscape across industries. While manufacturing, construction, services and recruitment experienced increasing rates of growth in the latest quarter, rate of growth among transport and wholesale SMEs has declined.

Looking at different sectors, transport businesses experienced the most buoyant recovery from the pandemic in 2020 and 2021, reaching 137 on the index in Q3 2021 – making it the strongest performing sector in the past three years. However, rate of growth has been easing off over the past year, from 137 in Q3 2021, down -15 points to 122 in Q2 2022.

Wholesale businesses have also seen their rate of turnover growth decline over the previous two quarters, from 131 in Q4 2021, down -27 points to 104 in Q2 2022, which could be attributed to seasonal fluctuation in orders.

Although recruitment firms experienced growth in Q2 2022, rising seven points from 91 in Q1 to 98 in Q2 2022, the index shows that turnover has still not reached pre-pandemic levels of growth, sitting at 98 in Q2 2022, compared with 102 in Q2 2019.

Manufacturing businesses have sustained a prolonged period of growth in turnover since Q3 2020, rising 21 points since then to 122 in Q2 2022.

Turnover in construction businesses has seen more volatility in the past year, dipping eight points from 112 in Q4 2021 to 104 in Q1 2022, but rising again by five points to 109 in Q2 2022.

Meanwhile, services turnover has remained relatively steady since it rose to 101 in Q3 2021, following the lifting of many COVID restrictions. Turnover growth now sits at 109, in Q2 2022.

Tracey Cotterill, head of global insight at BFS, said: “Our latest SME Revenue Index paints a picture of business resilience and recovery over the past two years – however, it also reveals volatility and vulnerability.

“Industries such as transport are already seeing stifled growth now, as rising fuel costs and supply chain disruption devastate their profit margins, while other industries such as manufacturing and construction experience steady, but mild growth trajectory since mid 2021. Overall, however, rate of growth has become subdued in Q2 and the outlook remains uncertain.”

Jonathan Andrew, BFS chief executive, said: “We know SMEs are incredibly resilient. But, coming out of the pandemic, many have lower cash buffers than before so are now more vulnerable as we face the worst cost of living crisis in decades.

“And, with the Government’s Recovery Loan Scheme closed to new business as of 30 June, there are fresh concerns that SMEs will struggle to access vital financing that could allow them to survive, let alone grow – with many lenders expected to tighten their credit policies over the coming weeks.

“As the underlying causes of inflationary pressures shift from the pandemic to conflict in Europe and labour shortages, it’s evident that the economy, and SMEs, are in for a rocky ride. What’s more, without a firm government in place at this time, SMEs are unlikely to be able to rely on effective state intervention anytime soon.”

He added: “In face of this, SMEs cannot afford to go into Q3 with their eyes shut. They must prepare and focus now on building resilience and protecting themselves against the effects of a downturn, reviewing supply chains, tightening credit control processes, mitigating currency fluctuations, understanding ways to unlock value from existing assets and managing costs accordingly. It will be those that plan and take proactive steps that will be best placed to weather the storm ahead.”